From IBD Cartoon Editorials...

From IBD Cartoon Editorials...

Monday, December 29, 2008

Wednesday, December 24, 2008

Christmas Day, 1776: 'Victory or Death'

On Christmas Day, 1776, a few Americans gave us the first installment of a gift we have all but lost.

After the makeshift American army under George Washington's command ousted the redcoats from Boston in early 1776, the British moved to New York City, where they launched an invasion in August. Washington met them head-on and suffered devastating defeats, and survived only by fleeing from the enemy.

During the sleepless nights and hungry days of their retreat across New Jersey, Washington had hoped to pick up support from the locals. But the opposite turned out to be true: In Newark, for instance, only 30 turned out to join the Americans, while on the same day 300 New Jerseyans fell in for the British.

By the time he escaped across the Delaware River into Bucks County, Pennsylvania, Washington had only 3,000 of his original 20,000 troops. Seeing American forces arriving in retreat only twelve miles from where they sat in Philadelphia, Congress exposed their backbone: They panicked, made excuses and fled. They gave Washington dictatorial powers and went into hiding in Baltimore, 110 miles to the south.

"The game is pretty near up," Washington wrote in a letter to his cousin in Virginia. Even the Bucks County militia let him down. Desperate for troops, he had ordered them called out, but they turned Loyalist, and he had to dismiss them.

As winter set in, Washington made headquarters in William McKonkey's three-story stone house on the west side of the Delaware. British commander William Howe had written to his superior in England, Lord Germaine, telling of the severity of the December weather. For that reason he would go into winter quarters until spring, leaving his men spread over numerous New Jersey outposts, ready to march at a moment's notice. He admitted, though, that the chain of outposts was too extensive.

Lord Charles Cornwallis, Howe's field commander, decided to garrison the outposts with Hessian mercenaries and send the British troops back to New York. He himself was anxious to return to his wife in England, while Howe continued his affair in New York with the wife of one of his officers. Cornwallis left command of New Jersey in the hands of the cocky and thoroughly mediocre General James Grant.

In the 100-house village of Trenton, the outpost closest to Washington, the 1,600 Hessians were under command of Colonel Johann Gottlieb Rall, a hard-drinking gambler whose troops had a reputation for plunder and rape. Once encamped. they proceeded to demonstrate their reputation. Hessian brutality swung many New Jersey neutrals to the American cause. Instead of tacking red ribbons to their doors indicating their loyalty to the Crown, they formed militia bands to ambush Hessian patrols. In his diary, one Hessian officer complained "we have not slept one night in peace since we came to this place." [1] He wrote this passage in Trenton, on Christmas Eve.

History tells us of the desperate condition of Washington's men - their ragged clothes, their lack of shoes, their chronic hunger. While this was true, it was also carefully exaggerated. Making excellent use of spies, Washington led the British to believe his condition was completely hopeless. Thus, when Rall complained to General Grant that his position was too much exposed, Grant dismissed it as ludicrous, since Washington was all but decimated. Besides, after December 31 Washington would not even have an army, since the term of service would expire for most of his men.

Perhaps at the suggestion of Benedict Arnold, Washington decided to attack Trenton while the Hessians slept off the effects of their Christmas celebration. It was do or die time; if he didn't take Trenton, the American cause was dead.

Benjamin Rush, one of the few members of Congress who remained in Philadelphia, paid Washington a visit on the morning of December 24, 1776. Seeing the general depressed, Rush tried to boost his spirits with talk about Congress being behind him, even as they ran like cowards. As they talked, Rush noticed Washington scribbling on scraps of paper, one of which fell to the floor. Rush picked it up and read, "Victory or Death." It was the watchword for the attack on Trenton.

The following afternoon, Christmas Day, Washington gave his officers their marching orders. They included a special oratory they would read to their men, in an attempt to boost their morale. Earlier that month, Tom Paine had written a new essay on a drumhead in General Nathanael Greene's tent as the American army retreated across New Jersey. Called The American Crisis, Paine had it printed in Philadelphia on December 19. As the troops prepared to climb aboard the boats and cross the Delaware, with a winter storm kicking up, they heard Paine's opening words: "These are the times that try men's souls." They would not forget them.

Under the direction of Marblehead ship captain John Glover, the first boats pushed off from McKonkey's Ferry at two in the afternoon. It took fourteen hours to transport men, horses, and artillery across the river. Ice floes crunched against the sides of the 60-foot Durham iron-ore barges as the boatmen, sleet slashing their eyes, poled the crafts over and back.

Meanwhile, in Trenton, Rall had eaten a hearty meal and retired for a game of cards with a few of his aides and his host, a man named Abraham Hunt. Shortly after midnight a shivering Loyalist from Bucks County showed up at the door with a written message, handing it to a servant. Rall refused to be disturbed and tucked the note into his waistcoat pocket without reading it.

At 4:00 a.m. the American troops began their ten-mile march to Trenton along River Road. Washington, from his tall chestnut horse, urged his men to keep moving and stay with their officers. Two men stopped to rest - and froze to death. At Birmingham, the force split into two divisions. One, led by Nathanael Greene, swung off to the east to skirt the town, while the other, under John Sullivan's command, headed straight for the main Hessian barracks on King Street.

At 8:00 a.m. Sullivan's advance guard rushed the ten Hessian pickets outside the barracks. Three minutes later Washington ordered the rest of the men to storm the town. As they fell upon the enemy, many of them shouted, "This is the time to try men's souls!" [2] With their gunpowder soaked and useless, Sullivan's men relied on the bayonet to roust the Hessians out of the houses. Earlier in New York, Rall's men had mercilessly slaughtered Americans as they tried to surrender. It was a gratifying sight to see the Hessians turning and running.

Sodden from the previous night's celebrations, some Hessian units threw on their coats and tried to form ranks in the streets. As they did, they were cut down by Henry Knox's six-pounders firing from the ends of Trenton's two main streets.

Rall finally broke from the Hunt house, jumped on his horse and galloped toward his regiment, who were marching down King Street to the sounds of fifes, bugles, and drums while being showered with grapeshot. "Lord, Lord, what is it, what is it?" he kept shouting in German. As he tried unsuccessfully to organize a bayonet charge, he was hit twice and assisted into the Queen Street Methodist Church. While he lay dying, someone noticed the unread note in his pocket: the American army was marching on Trenton.

Minutes later the remaining Hessian officers put their hats on their swords, the corporals lowered their flags, and the infantry men grounded their arms. The Battle of Trenton was over. The Americans had suffered four casualties to the two hundred Hessians killed and wounded. Some of the Hessians had escaped and would alert the Hessian unit at Princeton. After a brief council with his officers, Washington decided his men were in no shape to take on more Hessians that day, so they headed back to McKonkey's Ferry with captured weapons, supplies, and 948 prisoners.

It took them twelve hours to recross the Delaware. The weather had gotten so cold Americans and Hessians had to stamp their feet in time in the boats to break up the new ice that was slowing their passage. When the Continental troops finally collapsed into their tents, they had gone forty-eight hours without food, almost as long without sleep, and had marched 25 miles in freezing weather.

They also won a critical victory for independence and liberty. While no war is good, defensive wars are sometimes necessary. Our forefathers knew this. That's why some of them went marching, 226 years ago.

References

1. Randall, William Sterne, George Washington: A Life, Owl Books, Henry Holt & Company, New York, 1998, p. 321.

2. Rothbard, Murray N., Conceived in Liberty, Vol. IV, Mises Institute, Auburn, Alabama, 1999, pp. 198-199.

Tuesday, December 23, 2008

TAKING THE AIR OUT

Food inflation may fall to no more than 4.5 percent in 2009 as lower dairy costs give consumers relief from this year’s price gains, the highest in almost three decades, the U.S. Department of Agriculture said.

(Bloomberg News)

Combined with the crash in crude oil and gasoline prices, this deflation should function as a huge tax cut to consumers and many businesses as far as lower input costs. With that said, we need to recognize that runaway deflation can be catastrophic if not under control--and is far worse than inflation--. Also, this commodity tax cut cannot be said to offset the rising unemployment or rising foreclosures in quite the way the bulls want it to.

BOTTOM LINE: A food and energy tax cut is just what the doctor ordered for the American consumer and the struggling American business, but the medicine may indeed kill the patient if we cannot control deflation over the coming quarters. Sooner or later--if it hasn't already--crashing commodity prices will freak people out instead of offering a breather.

Monday, December 22, 2008

Head and Shoulders Bottom (Reversal)

Here's a bullish scenario from stockcharts.com. See if the information below relays to our current S&P 500 chart over the past three months...

The Head and Shoulders bottom is referred to sometimes as an Inverse Head and Shoulders. The pattern shares many common characteristics with its comparable partner, but relies more heavily on volume patterns for confirmation.

As a major reversal pattern, the Head and Shoulders Bottom forms after a downtrend, and its completion marks a change in trend. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. Ideally, the two shoulders would be equal in height and width. The reaction highs in the middle of the pattern can be connected to form resistance, or a neckline.

The price action forming both Head and Shoulders Top and Head and Shoulders Bottom patterns remains roughly the same, but reversed. The role of volume marks the biggest difference between the two. Generally speaking, volume plays a larger role in bottom formations than top formations. While an increase in volume on the neckline breakout for a Head and Shoulders Top is welcomed, it is absolutely required for a bottom. We will look at each part of the pattern individually, keeping volume in mind, and then put the parts together with some examples.

- Prior Trend: It is important to establish the existence of a prior downtrend for this to be a reversal pattern. Without a prior downtrend to reverse, there cannot be a Head and Shoulders Bottom formation.

- Left Shoulder: While in a downtrend, the left shoulder forms a trough that marks a new reaction low in the current trend. After forming this trough, an advance ensues to complete the formation of the left shoulder (1). The high of the decline usually remains below any longer trend line, thus keeping the downtrend intact.

- Head: From the high of the left shoulder, a decline begins that exceeds the previous low and forms the low point of the head. After making a bottom, the high of the subsequent advance forms the second point of the neckline (2). The high of the advance sometimes breaks a downtrend line, which calls into question the robustness of the downtrend.

- Right Shoulder: The decline from the high of the head (neckline) begins to form the right shoulder. This low is always higher than the head, and it is usually in line with the low of the left shoulder. While symmetry is preferred, sometimes the shoulders can be out of whack, and the right shoulder will be higher, lower, wider, or narrower. When the advance from the low of the right shoulder breaks the neckline, the Head and Shoulders Bottom reversal is complete.

- Neckline: The neckline forms by connecting reaction highs 1 and 2. Reaction High 1 marks the end of the left shoulder and the beginning of the head. Reaction High 2 marks the end of the head and the beginning of the right shoulder. Depending on the relationship between the two reaction highs, the neckline can slope up, slope down, or be horizontal. The slope of the neckline will affect the pattern's degree of bullishness: an upward slope is more bullish than downward slope.

- Volume: While volume plays an important role in the Head and Shoulders Top, it plays a crucial role in the Head and Shoulders Bottom. Without the proper expansion of volume, the validity of any breakout becomes suspect. Volume can be measured as an indicator (OBV, Chaikin Money Flow) or simply by analyzing the absolute levels associated with each peak and trough.

- Volume levels during the first half of the pattern are less important than in the second half. Volume on the decline of the left shoulder is usually pretty heavy and selling pressure quite intense. The intensity of selling can even continue during the decline that forms the low of the head. After this low, subsequent volume patterns should be watched carefully to look for expansion during the advances.

- The advance from the low of the head should show an increase in volume and/or better indicator readings, e.g., CMF > 0 or rise in OBV. After the reaction high forms the second neckline point, the right shoulder's decline should be accompanied with light volume. It is normal to experience profit-taking after an advance. Volume analysis helps distinguish between normal profit-taking and heavy selling pressure. With light volume on the pullback, indicators like CMF and OBV should remain strong. The most important moment for volume occurs on the advance from the low of the right shoulder. For a breakout to be considered valid, there needs to be an expansion of volume on the advance and during the breakout.

- Neckline Break: The Head and Shoulders Bottom pattern is not complete, and the downtrend is not reversed until neckline resistance is broken. For a Head and Shoulders Botom, this must occur in a convincing manner, with an expansion of volume.

- Resistance Turned Support: Once resistance is broken, it is common for this same resistance level to turn into support. Often, the price will return to the resistance break, and offer a second chance to buy.

- Price Target: After breaking neckline resistance, the projected advance is found by measuring the distance from the neckline to the bottom of the head. This distance is then added to the neckline to reach a price target. Any price target should serve as a rough guide, and other factors should be considered, as well. These factors might include previous resistance levels, Fibonacci retracements or long-term moving averages.

Alaska Air Group, Inc. (ALK) formed a head and shoulders bottom with a downward sloping neckline.Key points include:

- The stock began a downtrend in early July, and declined from 60 to 26.

- The low of the left shoulder formed with a large spike in volume on a sharp down day (red arrows).

- The reaction rally at around 42 1/2 formed the first point of the neckline (1). Volume on the advance was respectable with many gray bars exceeding the 60-day SMA. (Note: gray bars denote advancing days, black bars declining days and the thin red horizontal is the 60-day SMA).

- The decline from 42 1/2 to 26 (head) was quite dramatic, but volume did not get out of hand. Chaikin Money Flow was mostly positive when the lows around 26 were forming.

- The advance off of the low saw a large expansion of volume (green oval) and gap up. The strength behind the move indicated that a significant low formed.

- After the reaction high around 39, the second point of the neckline could be drawn (2).

- The decline from 39 to 33 occurred on light volume until the final two days, when volume reached its highest point in a month. Even though there are two long black (down) volume bars, these are surrounded by above-average gray (up) volume bars. Also notice how trend line resistance near 35 became support around 33 on the price chart.

- The advance off of the low of the right shoulder occurred with above average volume. Chaikin Money Flow was at its highest levels, and surpassed +20% shortly after neckline resistance was broken.

- After breaking neckline resistance, the stock returned to this newfound support with a successful test around 35 (green arrow).

AT&T (T) formed a head and shoulders bottom with a flat neckline. The shoulders are a bit shallow, but the neckline and head are well pronounced. Key points include:

- The stock established a 6-month downtrend with the trend line extending down from Mar-98.

- After a head fake above the trend line in late June, the stock fell from 66 to 50 with a sharp increase in volume to form the left shoulder.

- The rally to 61 met resistance from the trend line, and the reaction high became the first point of the neckline.

- The decline from 61 to 48 finished with a piercing pattern to form the low of the head. Even though volume was heavy when the long black candlestick formed, the subsequent reversal occurred on even higher volume. This reversal was followed with a number of strong advances and up gaps. Also notice that Chaikin Money Flow was above +10% when the low of the head formed.

- The advance from the low of the head broke above the trend line, extending down from Mar-98, and met resistance around 61. This reaction high formed the second point of the neckline.

- The right shoulder was quite short and shallow. The low was recorded at 57 and Chaikin Money Flow remained above +10% the whole time. Support was found from the trend line that offered resistance a few weeks earlier.

- The stock advanced sharply off of lows that formed the right shoulder, and volume increased three straight days (blue arrow). This is a bit early, but volume remained just above average for the neckline breakout a few days later. Also Chaikin Money Flow remained above +10% the whole time.

- After the break of neckline resistance, the stock tested this newfound support twice while consolidating recent gains. The power arrived a few weeks later with a strong move off support and a huge increase in volume. The stock subsequently advanced from the low sixties to the low eighties.

Head and Shoulder Bottoms are one of the most common and reliable reversal formations. It is important to remember that they occur after a downtrend and usually mark a major trend reversal when complete. While it is preferable that the left and right shoulders be symmetrical, it is not an absolute requirement. Shoulders can be different widths as well as different heights. Keep in mind that technical analysis is more an art than a science. If you are looking for the perfect pattern, it may be a long time coming.

Analysis of the Head and Shoulders Bottom should focus on correct identification of neckline resistance and volume patterns. These are two of the most important aspects to a successful read, and by extension a successful trade. The neckline resistance breakout combined with an increase in volume indicates an increase in demand at higher prices. Buyers are exerting greater force, and the price is being affected.

As seen from the examples, traders do not always have to chase a stock after the neckline breakout. Often, but certainly not always, the price will return to this new support level offer a second chance to buy. Measuring the expected length of the advance after the breakout can be helpful, but don't count on it for your ultimate target. As the pattern unfolds over time, other aspects of the technical picture are likely to take precedent. Technical analysis is dynamic, andand your analysis should incorporate aspects of the long-, medium- and short-term picture.

Wednesday, December 17, 2008

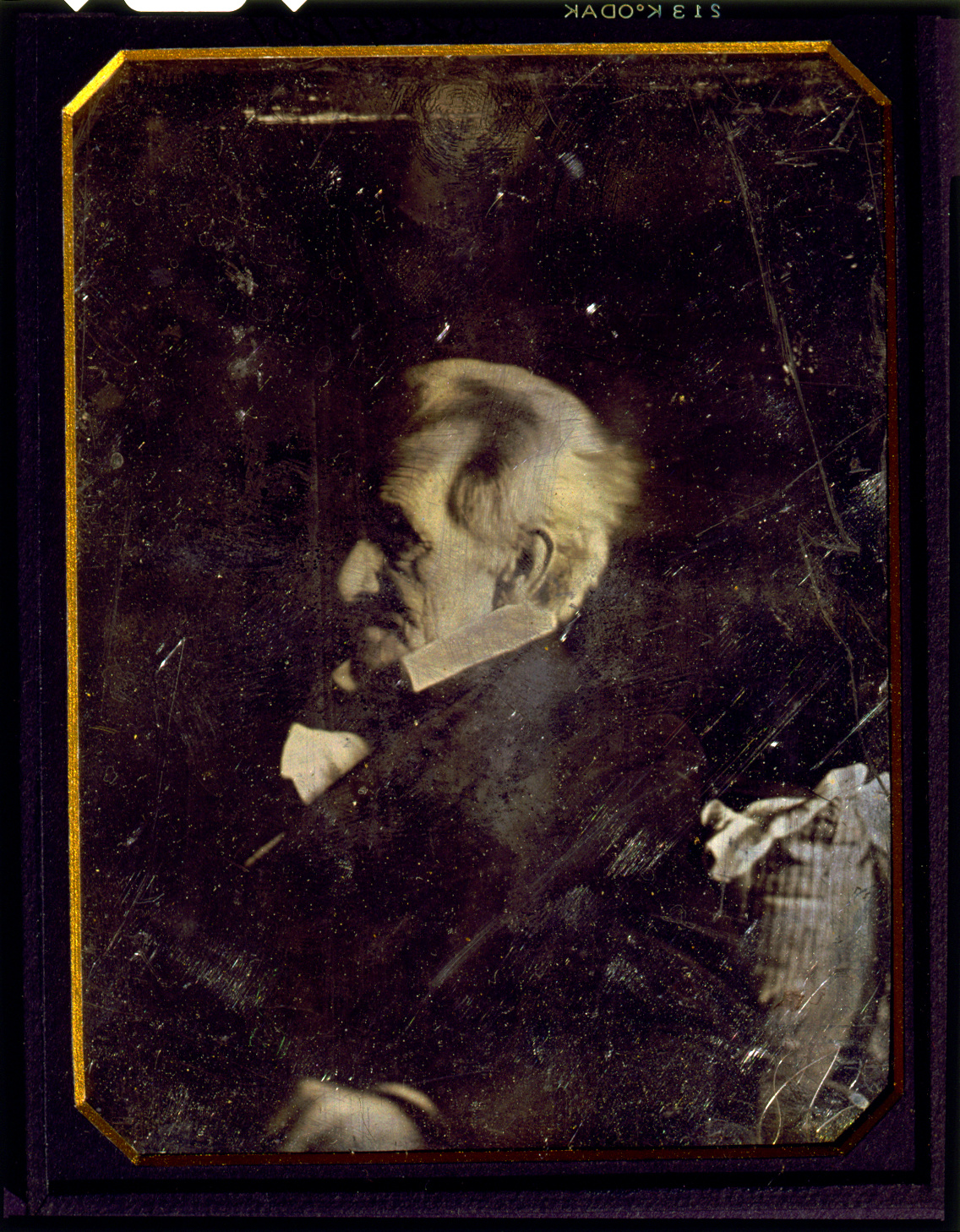

OLD HICKORY ON BAILOUTS

President Andrew Jackson to a group of bankers in 1832 before he annulled the Second U.S. Bank due to corruption:

President Andrew Jackson to a group of bankers in 1832 before he annulled the Second U.S. Bank due to corruption:Friday, December 12, 2008

WHAT A LONG STRANGE MARKET IT'S BEEN

For the past year, I have basically traded around this stock market with great success. At one point I was well ahead of the major averages. Much of that changed in early August, when I saw commodity prices crashing and equities in general as well. My favorite company in the entire market has been Foster Wheeler for quite some time. At $48, coming down from $85, it looked like a steal to me. I therefore began to buy on the way down. Little did I know that, like several other high quality stocks during the past few months, Foster Wheeler would not be spared the nasty deleveraging and overall panic out of stocks that has taken place since September.

At one point, FWLT reached $13.85, and the only way to keep my sanity was to laugh at the absurdity of the way the market was valuing the stock seeing as the company has very little debt and $9/share in cash! I could have easily panic sold, and still can, as the stock closed this week at $25.38. But the fact is that FWLT has done everything correct. They are valued at around a $3 Billion market cap even though their backlog is $8 billion. Their balance sheet is pristine and the management has been applying the share buyback program of $750,000,000 which is a sizeable portion of the company's value. The company also says it is in the process of signing off on eight mega-deals over the next several months.

In short, Foster Wheeler offers both amazing growth and value. To bet against Foster Wheeler now is to bet that the world will cease to grow--especially in cash rich regions like Asia and the Middle East--where many of the big energy infra projects are now.

It's been a painful ride, but I'm more confident than ever that I'll emerge in the next 1-3 years with a huge profit from FWLT.